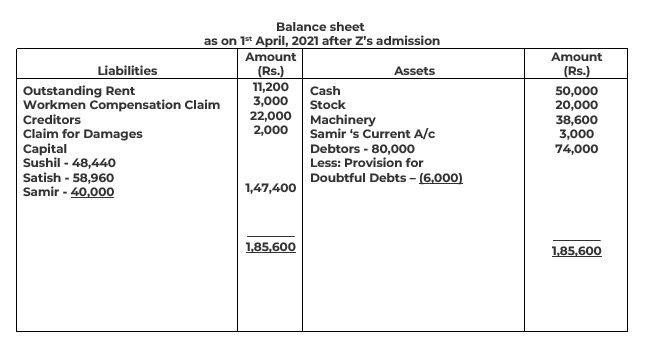

| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

| Outstanding Rent | 13,000 | Cash | 10,000 |

| Creditors | 20,000 | Sundry Debtors – 80,000 | |

| Workmen Compensation Reserve | 5,600 | Less: Provision for Doubtful Debts – (4,000) | 76,000 |

| Capital A/c : | Stock | 20,000 | |

| Sushil – 50,000 | Profit and Loss A/c | 4,000 | |

| Satish – 60,000 | 1,10,000 | Machinery | 38,600 |

| 1,48,600 | 1,48 ,600 |

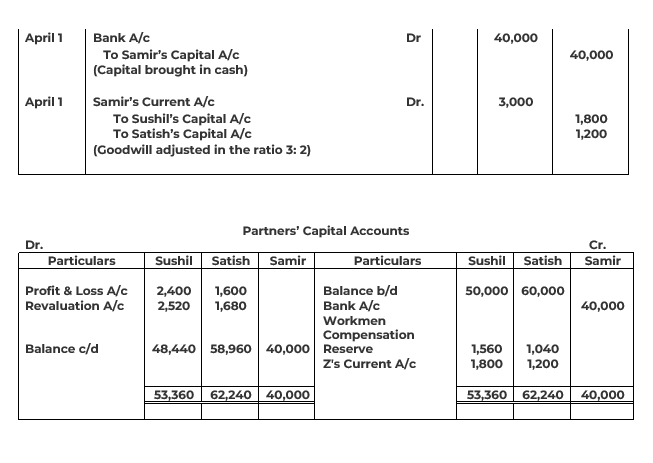

On 1st April, 2021, they admitted Samir as a partner for 1/6th share on the following terms:

(i) Samir brings in Rs. 40,000 as his share of Capital but he is unable to bring any amount for Goodwill.

(ii) Claim on account of Workmen Compensation is Rs. 3,000.

(iii) To write off Bad Debts amounted to Rs. 6,000.

(iv) Creditors are to be paid Rs. 2,000 more.

(v) There being a claim against the firm for damages, liabilities to the extent of Rs. 2,000 should be created.

(vi) Outstanding rent be brought down to Rs. 11,200.

(vii) Goodwill is valued at 112 years’ purchase of the average profits of last 3 years, less Rs. 12,000. Profits for the last 3 years amounted to Rs. 10,000; Rs. 20,000 and Rs. 30,000. Pass Journal entries, prepare Partners’ Capital Accounts and opening Balance Sheet.

SOLUTION

Working Notes:

WN1: Calculation of Goodwill

Average Profit = 10,000 + 20,000 + 30,000/3 = 60,000/3 = Rs. 20,000

Goodwill = Average Profits × Number of years’ purchase

= (20,000 × 1.5) – 12,000 = 30,000 – 12,000 = Rs. 18,000

WN 2:

Calculation of Z’s share of goodwill

Samir’s share of goodwill = 18,000 × 1/6 = Rs. 3,000