| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

| Capital A/cs: | Land and Building | 40,000 | |

| Kalpana – 50,000 | Plant ad Machinery | 70,000 | |

| Kanika – 80,000 | 1,30,000 | Stock | 30,000 |

| General Reserve | 10,000 | Debtors – 35,000 | |

| Creditors | 70,000 | Less: Provision for Doubtful Debts – 1,000 | 34,000 |

| Investments | 26,000 | ||

| Cash | 10,000 | ||

| 2,10,000 | 2,10,000 |

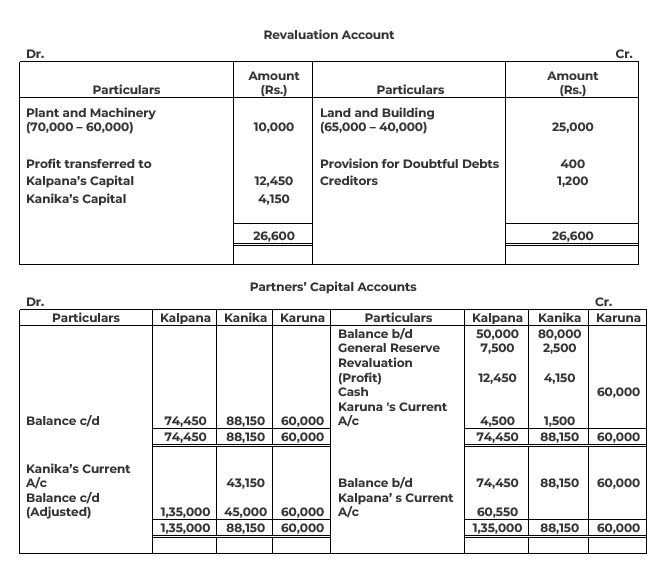

The other terms agreed upon were:

(a) Goodwill of the firm was valued at Rs. 24,000.

(b) Land and Building were valued at Rs. 65,000 and Plant and Machinery at Rs. 60,000.

(c) Provision for Doubtful Debts was found in excess by Rs. 400.

(d) A liability of Rs. 1,200 included in Sundry Creditors was not likely to arise.

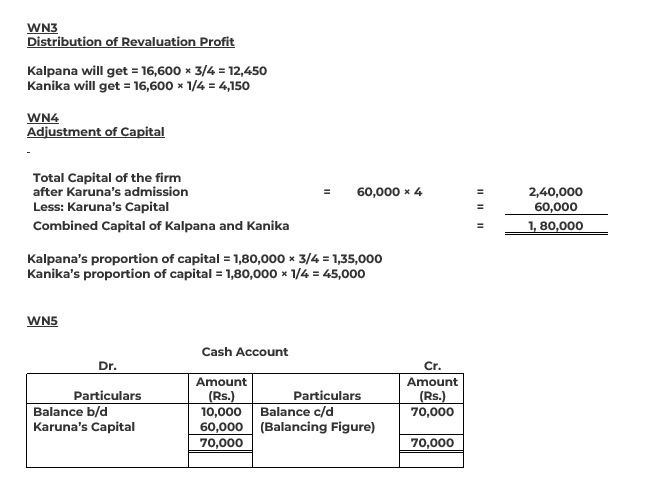

(e) The capitals of the partners be adjusted on the basis of C’s contribution of capital to the firm.

(f) Excess of shortfall, if any, be transferred to Current Accounts.

Prepare Revaluation Account, Partners’ Capital Accounts and Balance Sheet of the new firm.

SOLUTION