| Liabilities | Amount (Rs.) | Assets | Amount (Rs.) |

| Madhu’s Capital | 5,20,000 | Land and Building | 3,00,000 |

| Vidhi’s Capital | 3,00,000 | Machinery | 2,80,000 |

| General Reserve | 30,000 | Stock | 80,000 |

| Bills Payable | 1,50,000 | Debtors – 3,00,000 | |

| Less: Provision – (10,000) | 2,90,000 | ||

| Bank | 50,000 | ||

| 10,00,000 | 10,00 ,000 |

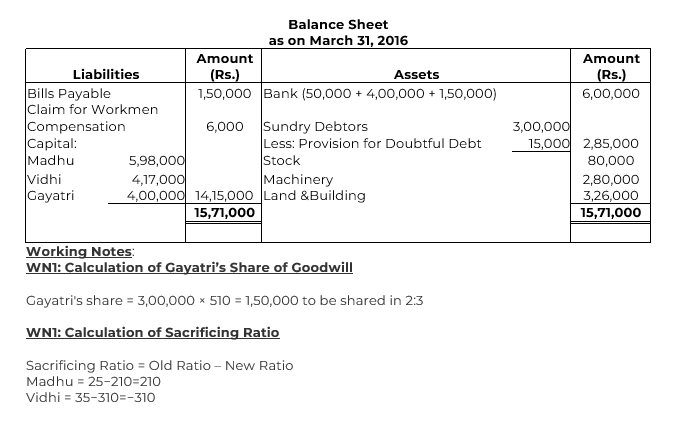

Madhu and Vidhi decided to admit Gayatri as a new partner from 1st April, 2016 and their new profit-sharing ratio will be 2 : 3 : 5. Gayatri brought Rs. 4,00,000 as her capital and her share of goodwill premium in cash.

(a) Goodwill of the firm was valued at Rs. 3,00,000.

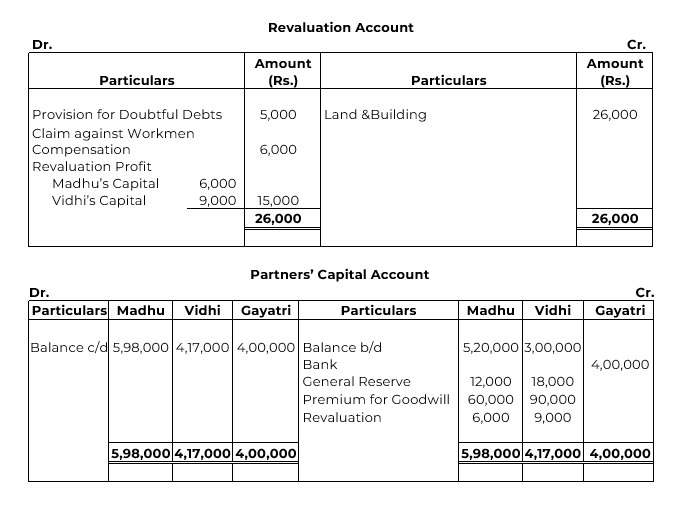

(b) Land and Building was found undervalued by Rs. 26,000.

(c) Provision for doubtful debts was to be made equal to 5% of the debtors.

(d) There was a claim of Rs. 6,000 on account of workmen compensation.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of the reconstituted firm.

Solution